internet tax freedom act texas

Ohio South Dakota Texas and Wisconsin. The states would have collected nearly 1 billion in fiscal year 2021.

Ad See If You Qualify For IRS Fresh Start Program.

. The Internet Tax Freedom Act of 1998 ITFA. Beginning July 1 2020 Texas will no longer impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016. Hawaii New Mexico North Dakota7 Ohio South Dakota Texas and Wisconsin8 According to a recent survey these seven states collect a combined 563 million per year.

Internet access fees are currently subject to state and local sales tax in Hawaii New Mexico Ohio South Dakota Texas and Wisconsin. The bill also establishes an end date of June 30 2020 for the seven states that currently impose a tax on internet access. South Dakota Texas The Hill newspaper Unfunded Mandates Reform Act of 1995.

The Permanent Internet Tax Freedom Act is a bill that would amend the Internet Tax Freedom Act to make permanent the ban on state and local taxation of Internet access and on multiple or discriminatory taxes on electronic commerce. The Permanent Internet Tax Freedom Act HR. Texas collected tax on internet access prior to the enactment of ITFA under the Taxables Services provision of its Tax Code see older 1510101a.

Today the internet hardly requires extraordinary. The Internet Tax Freedom Act ITFA the moratorium on taxing internet access was recently extended to December 11 2014 from its initial expiration date of November 1 2014. Under the grandfather clause included in the Internet Tax Freedom Act Texas is currently collecting a tax on Internet access charges over 2500 per month.

These states are under the grandfathered clause allowed to tax internet access because they implemented a tax prior to. Beginning July 1 2020 Texas will no longer impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016. Based On Circumstances You May Already Qualify For Tax Relief.

It is likely that these taxes cannot be legally imposed on Internet access providers because the taxes appear to satisfy the definition of a prohibited tax on Internet access under the Internet Tax Freedom Act ITFA. This report discusses the Internet Tax Freedom Act ITFA. Hegar a test case pending in Texas.

Congress extended the ITFA. But the grandfather clause has permitted such taxes if they were generally imposed and actually enforced prior to October 1 1998. The grandfather clause that permits Internet access taxes that were generally imposed and actually enforced.

On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the Permanent Internet Tax Freedom Act PITFA. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1 new. Online sellers are still required to collect sales tax when selling items to buyers in states where you have sales tax nexus.

Kentucky Michigan Ohio and Texas have recently enacted gross receipts taxes. While the Internet Tax Freedom Act ITFA and its permanent counterpart PIFTA prevents states from imposing taxes on things like actually accessing the internet they do not have anything to do with eCommerce sales. As of July 1 2020 those fees will be exempt.

The exemption is mandated by the Internet Tax Freedom Act ITFA which was first enacted in 1998 to encourage growth of the fledgling internet. Little-noticed changes to the Internet Tax Freedom Act made by Congress in 2007 expanding the scope of services preempted from state taxation are at issue in Apple Inc. Hawaii New Mexico North Dakota7 Ohio South Dakota Texas and Wisconsin8 According to a recent survey these seven states collect a combined 563 million per year.

The law bars federal. The bill was introduced and passed in the United States House of Representatives during the 113th. 105-277 which enacted in 1998 implemented a three-year moratorium preventing state and local governments from taxing Internet access or imposing multiple or.

Internet Tax Freedom Act ITFA The ITFA was enacted in 1998 as a 3-year moratorium preventing governments at the local state and federal levels from imposing transaction taxes on internet access one of the exceptions being that states already taxing internet access as of October 1 1998 were grandfathered in. Free Case Review Begin Online. 3086 is a bill that would amend the Internet Tax Freedom Act to make permanent the ban on state and local taxation of Internet access and on multiple or discriminatory taxes on electronic commerce.

The new act the Internet Tax Freedom Act Amendments Act of 2007 included a new definition of internet access which means a service that enables users to connect to the Internet to access content information or other services. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1 new. The Internet Tax Freedom Act ITFA was enacted in 1998 to delay any special taxation of.

On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to continue doing so will expire. The Internet Tax Freedom Act of 1998 ITFA. By Chanel Christoff Davis in Sales Tax State Sales Tax Laws Texas.

Federal law included a grandfather clause for those state and local governments including Texas who imposed a. Accordingly the six remaining states that tax Internet access Hawaii New Mexico Ohio South Dakota Texas and Wisconsin must by federal law stop. On June 30th 2020 the Internet Tax Freedom Acts grandfather clause will expire.

ITFA prohibits states and political subdivisions from imposing taxes on Internet access.

Texas Sales Tax Guide For Businesses

Sales Tax By State Is Saas Taxable Taxjar

States With Highest And Lowest Sales Tax Rates

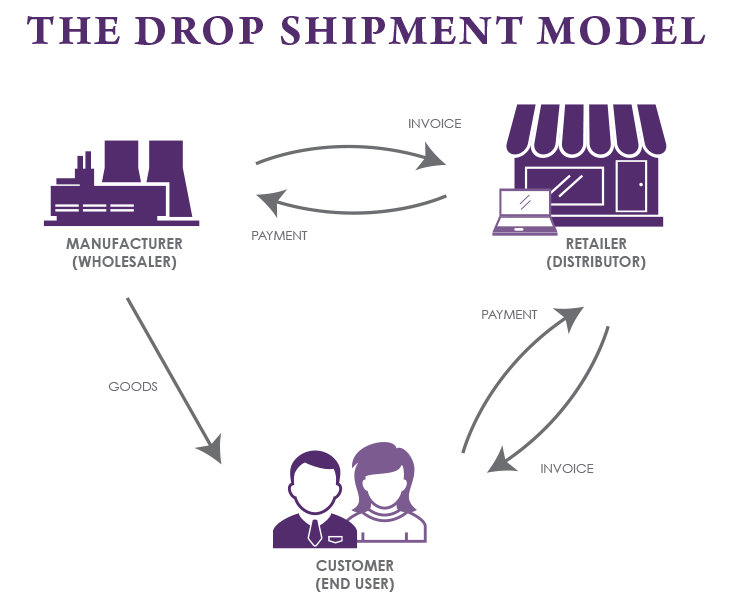

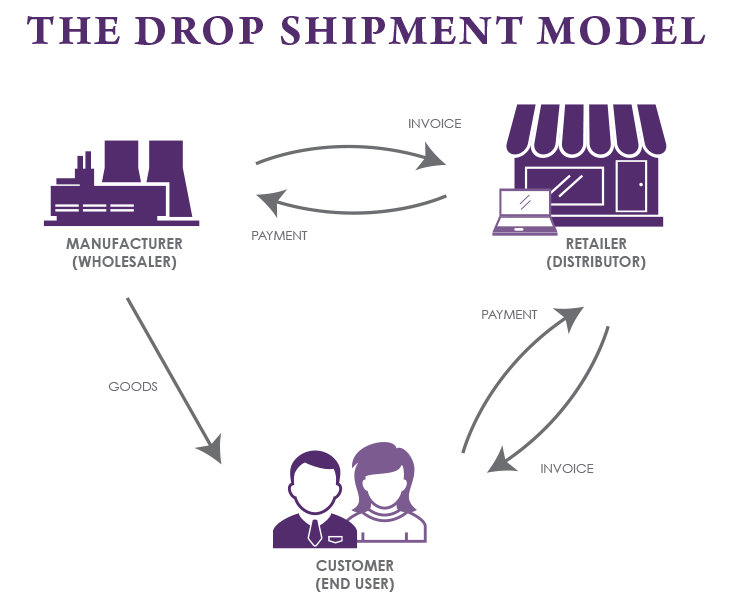

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

A Look At Justice Alito S Dissent As Scotus Blocks Texas Social Media Law

How Texas Spends Its Money How Texas Gets Its Money Why It Doesn T Add Up

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

How Texas Spends Its Money How Texas Gets Its Money Why It Doesn T Add Up

Texas Sales Tax Guide For Businesses

Texas Sales Tax Guide For Businesses

How Texas Spends Its Money How Texas Gets Its Money Why It Doesn T Add Up

The Difference Between A Federal Charge Vs State Charge

/cloudfront-us-east-2.images.arcpublishing.com/reuters/CR3HLX7HG5IK5OQQRV4LU5EXVM.jpg)

Texas Lawmakers Target Law Firms For Aiding Abortion Access Reuters

How Texas Spends Its Money How Texas Gets Its Money Why It Doesn T Add Up